Is Ocado really a leader in online grocery?

For years, the British online pure-play grocery retailer has touted that they are the future of the online grocery business. The company has emphasised that its advantage will become visible when the industry moves online.

However, as the pandemic hit, Ocado's main online rivals, Tesco and Sainsbury’s, were much quicker to scale up online operations.

In 2019, Tesco online was 114% bigger than Ocado. For 2022 that gap has widened so that Tesco is 177% bigger than Ocado.

Ocado lost significant market share during the pandemic. That led to a drastic build-up of new capacity for Ocado. However, the demand has faded as that capacity has become available.

Currently, Ocado has a capacity for 700 000 orders per week, but they are doing around 400 000 orders per week.

One has to wonder if Ocado did benefit at all from the pandemic. If one looks at the historical revenue growth for the company and excludes the pandemic years, with a historical growth trajectory, Ocado would have ended up around the same revenue levels as they are now.

The elusive profitability

The other big topic in the UK grocery media is that Ocado has been unable to generate any profits. The company has said that it will become profitable in the following years. The chart by the Times illustrates well how Ocado has been trying to reach profitability but has yet to be able to do that.

Image source: The Times

However, one reason for the need for more profits during the last years has also been the investments in the International Solutions business.

The International Solutions business is something that Ocado has emphasised heavily in strategic communication. It is the central part of the business going into the future.

High-margin International Solutions

That is highlighted in the way Ocado has tried to sell off its retail business to other companies. First, the retail business collaborated with John Lewis Partnership-owned grocery chain Waitrose. As the relationship with Waitrose became more problematic, and the John Lewis partnership sold off its ownership, Ocado partnered with Marks & Spencer, which currently owns 50% of Ocado Retail.

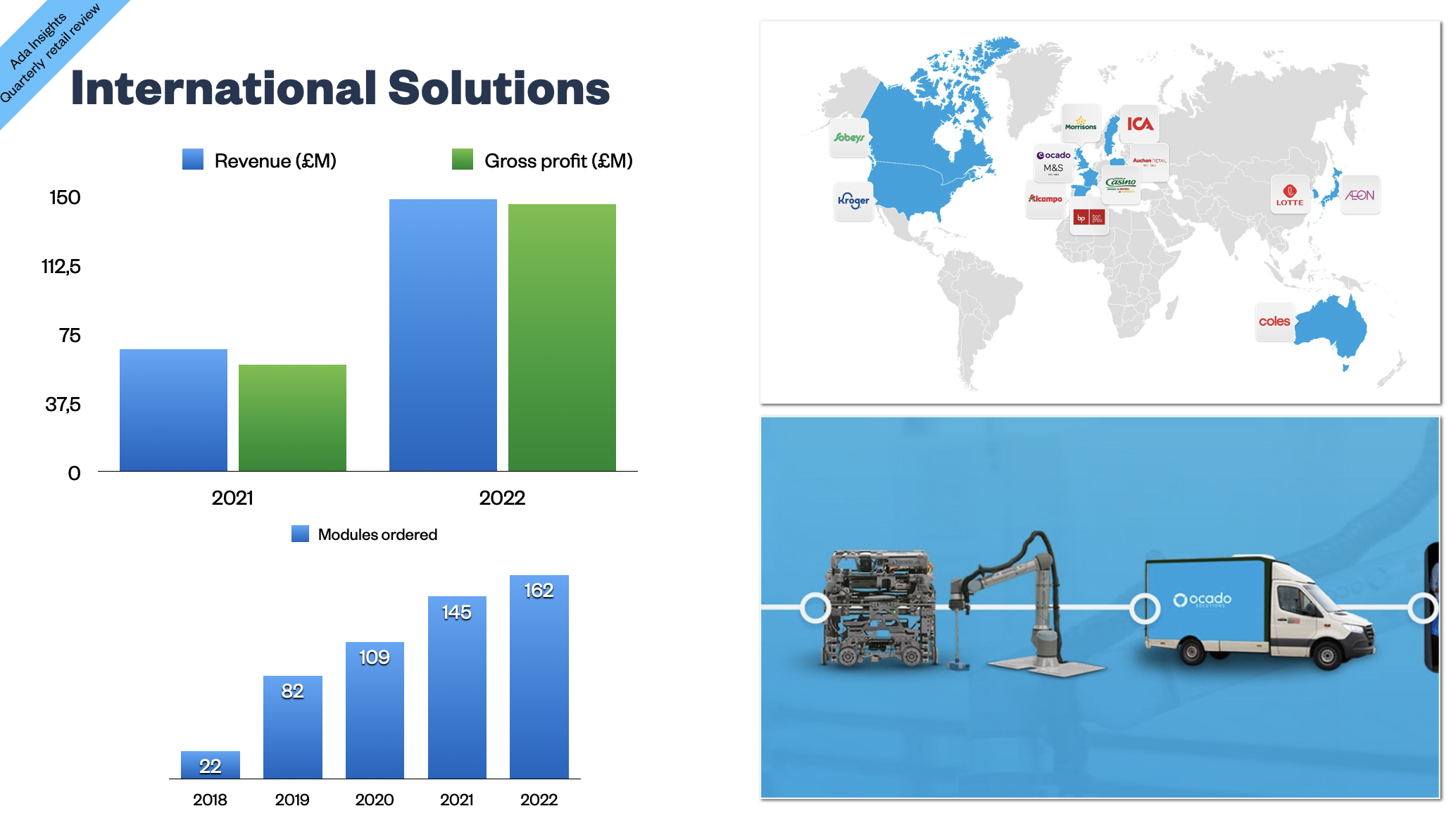

The international solutions business has required significant investments. However, Ocado has successfully sold its technology to international partners, such as Kroger in the US and ICA in Sweden.

During the last year, the International Solutions business saw its first notable revenue increase. The other thing to notice is that as the number of Ocado warehouses operational abroad has started to grow, the profitability of the international business increases.

The gross margins of the international business are very lucrative at 95% compared to 30+% for the Retail business.

Is Ocado a leading online grocer?

However, one final question regarding Ocado’s international business is that Ocado has not been a great online retailer, even though it has claimed to be the most advanced technology provider for online grocery. Ocado's customer proposition for consumers is good, but its rivals in the UK seem to be doing a better job for the customers. With regards to efficiency, the other key selling point for Ocado technology, Ocado does not seem to be the most advanced.

The often-used efficiency measure for the fulfilment, UPH (Units Per Hour), is low compared to some peers. For example, Norwegian Oda has claimed to have a UPH of 215, significantly higher than Ocado's 175. Also, the other efficiency metric, deliveries per van per week, has not been high by international standards and has even decreased.

Ocado is also said to be an expensive partner for retailers, and it takes a long time to build the warehouse. This begs the question of whether Ocado’s future partners could have more cost-efficient options.