HelloFresh back to growth with Ready-To-Eat products

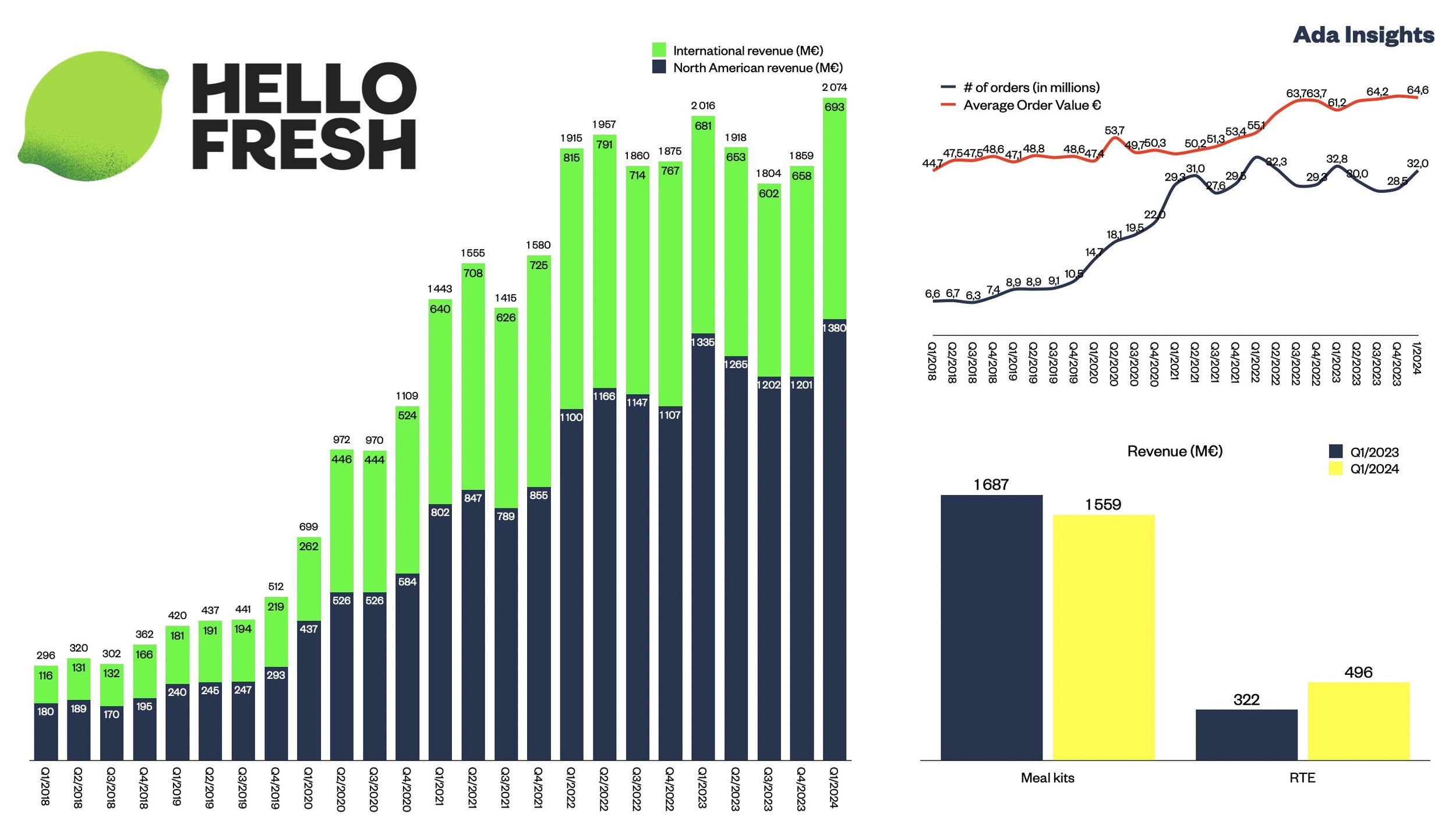

The German meal kit maker returned to low single-digit revenue growth after three quarters of slightly declining revenue. The 2,8% revenue increase was driven by the relatively new Ready-To-Eat (RTE) business segment. In terms of the two main geographies, HelloFresh grew in both of the main markets, North America and International.

The core meal kit business continued to see declining revenues, with -7,6% drop in sales. At the same time, the RTE segment saw a robust +54,1% growth. This was the first time the company reported revenues for these two segments. It turns out that the RTE segment has quickly become an essential part of the company, especially for its growth.

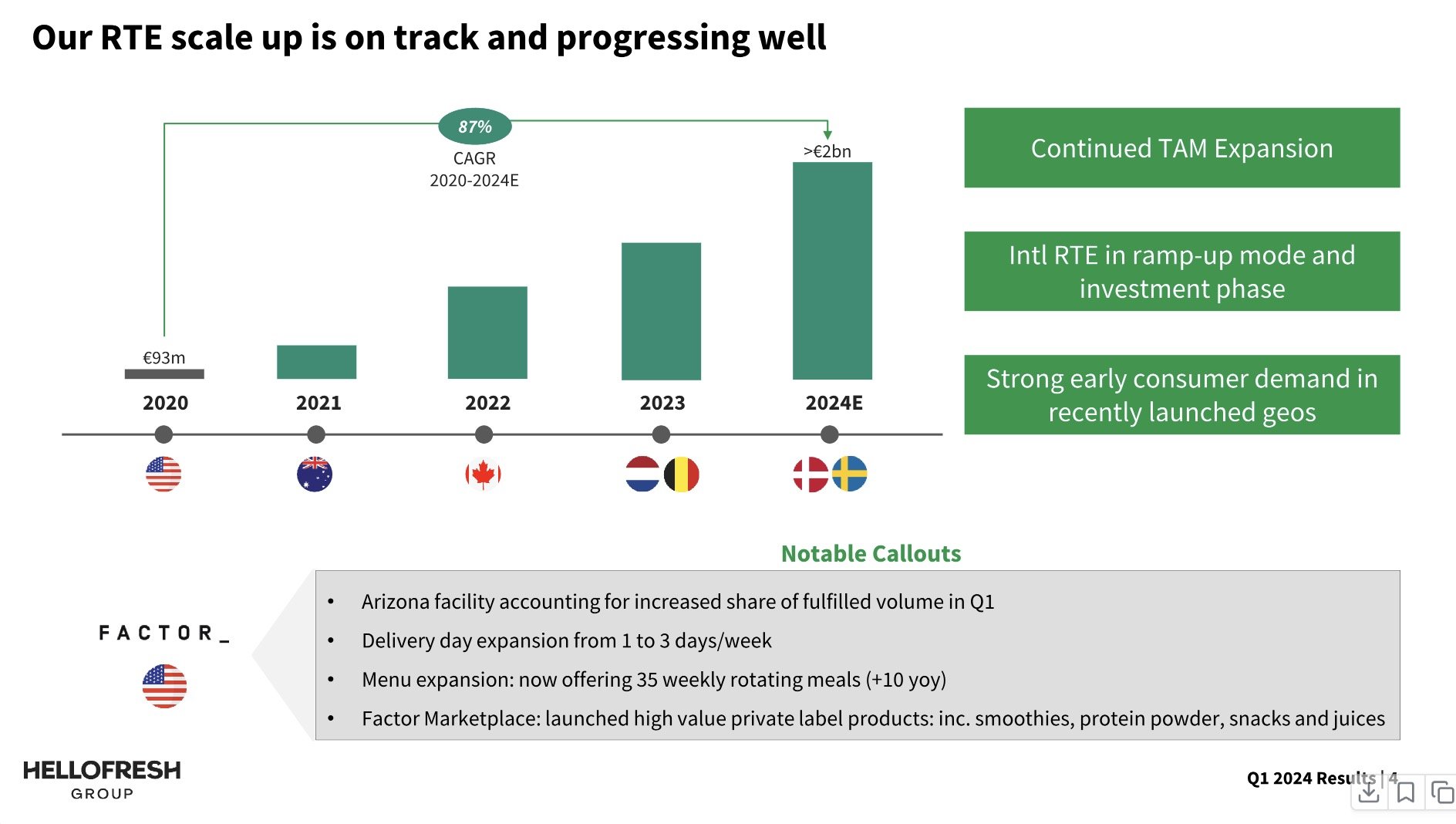

The company estimates that the RTE segment will continue its rapid growth. HelloFresh has launched RTE solutions in five markets and aims to launch two new ones this year (Denmark and Sweden). This will push the segment to above two billion in revenues this year.

The RTE segment will be the company's most important growth driver in the coming years, and one of the core strategic priorities is ”laser focus on the scale-up of our RTE operations in the U.S. and the internationalization of that business line. And this will remain the single biggest growth driver for the group for the remainder of 2024 and also in 2025.” (Dominik Richter, CEO of HellFresh)

The scale-up of the RTE business is costly for the company and will influence its ability to generate profits in the short term. However, with the slowdown in the meal kit business, RTE offers the company a way to continue the growth trajectory. Additionally, RTE is a way to increase the “share of stomach” for the company. This means that HelloFresh is able to take a bigger share of the customers’ money spent on food.

Besides the RTE segment, the growth was also driven by higher average order values (AOV). They grew 5,6% from the year before. This is probably because HelloFresh has been increasing the amount of ready meals and HelloFresh Market products in the baskets.

Average Order Values highlight the second crucial strategic priority for the company, improving customer loyalty.

“The second priority is to continuously improve the customer lifetime values of our customer base by strengthening the product proposition and shifting investment from acquisition into our products and towards existing customers. This includes a number of initiatives such as menu enhancements with a higher share of customizable meals, a broader assortment in HelloFresh Market, and the launch of our HelloFresh loyalty program in Q4. All of these initiatives and this strategy is aimed at further positively impacting both the average order rates and AOV of our customers and hence, to increase customer lifetime values.”