Swedish grocery market returning to more normal times - online back to solid growth

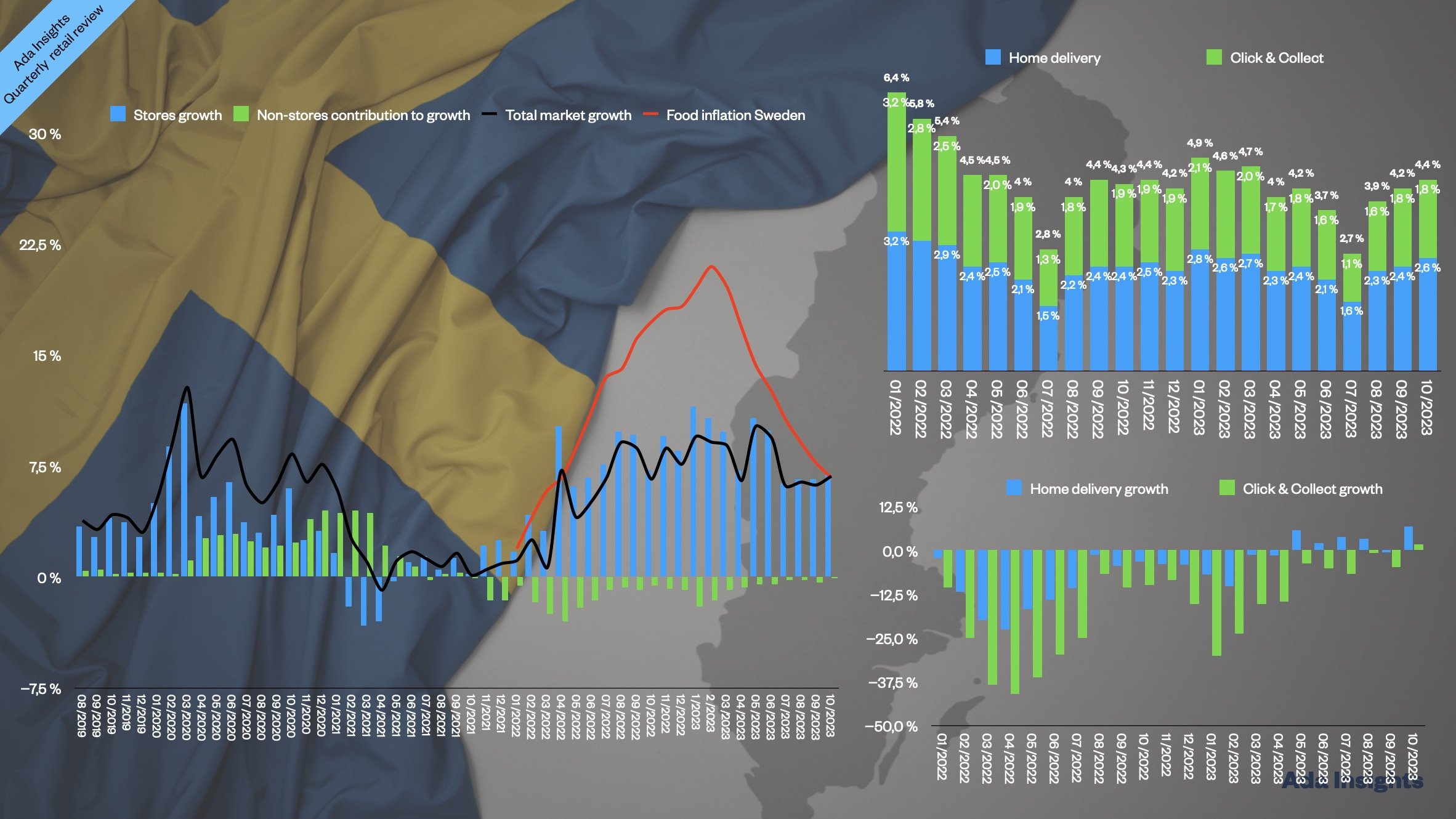

October was the ninth consecutive month of inflation slowing down in the Swedish grocery market. The decline of inflation resulted in the small growth of sales volumes as the overall market growth eaked only slightly above the inflation numbers (6,8% vs. 6,7%).

This was the first time in a long time when the sales volumes increase in the grocery business. Sign of things to come?

Will the slowing down of inflation change the market dynamics?

The growth of inflation has dramatically changed the competitive dynamics in the grocery industry, both in Sweden and Finland (as well as in other countries, such as the UK). Will the competitive dynamics change again if the price pressures start to help?

If yes, which companies will take advantage of the situation? The first logical answer would be the more quality-oriented players like ICA and Kesko. However, there is no sign of an improvement in the overall economic environment. This would suggest that the customers' purchasing power, especially willingness, has not yet improved.

Another critical question is which retailers can and want to start lowering prices first? Kesko and ICA (and especially their entrepreneurs) have seen profit margins tighten. This might lead to a situation where some entrepreneurs might prefer to improve margins instead of lowering prices.

Online back to growth - also Click & Collect

Sweden's Click & Collect channel has returned to growth (only +1,6%) after 24 consecutive months of declining revenues. Home delivery has returned to growth earlier. During the last six months, online revenues have declined only once.

In October home delivery revenues grew by a solid +6,7%. This is only 0,2%-points less than what the store business grew.

The declining inflation will also likely help the online channel return to a more solid growth trajectory. In October, online represented 4,4% of all groceries sold in Sweden. This is slightly higher than a year ago but still below the pandemic highs.

Home delivery accounts for 2,6% (60% of all online revenues) of grocery spend. That is almost at the same level as during the pandemic years (2,7% in 10/2021 & 10/2020).

It will be interesting to see how much online continues to grow towards the dark winter months, the peak season for online groceries (from November to March). The overall grocery market environment hopefully helps in that growth.