Walmart & TJX growth signalling the importance of price competitiveness

Most of the big US retailers have this week reported their quarterly earnings. Of the most important retailers, only Amazon (reported already on 27.10.2023) and Costco (to report on 14.12.2023) did not report this week.

Walmart, Home Depot, Target, and TJX reported this week. This gives a good glimpse into the current state of US retailing. These retailers are all massive and sell a diverse range of products.

On the top level, it is clear that growth is challenging to get in this market environment. Both Target and Home Depot reported declining sales. This was Target's second straight quarter and Home Depot's third quarter.

At the same time, both Walmart and TJX reported robust growth. TJX reported +9% growth from last year.

Walmart with a strong quarter on all fronts

The Arkansas-based behemoth reported a +5,2% growth for the total business. The US business grew slightly less, whereas the International business has found a new growth level, as it reported a third 10+% growth quarter.

For the most significant segment, the US, the growth was driven by grocery and health & beauty. Both of them are categories that tend to keep growing even though other segments struggle. For Walmart US, grocery sales grew by ”mid single-digits”, whereas health & beauty sales grew by ”high teens”.

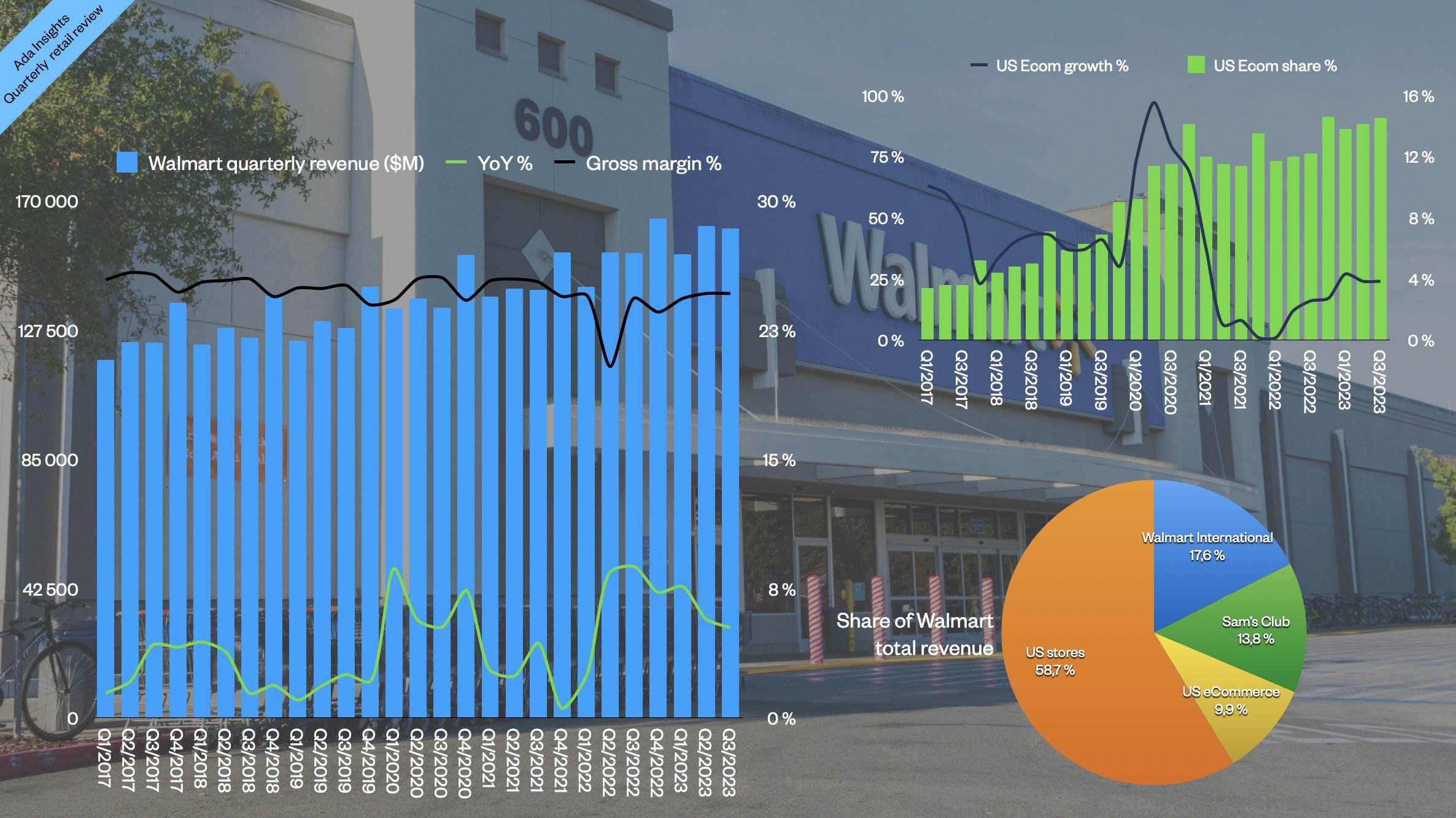

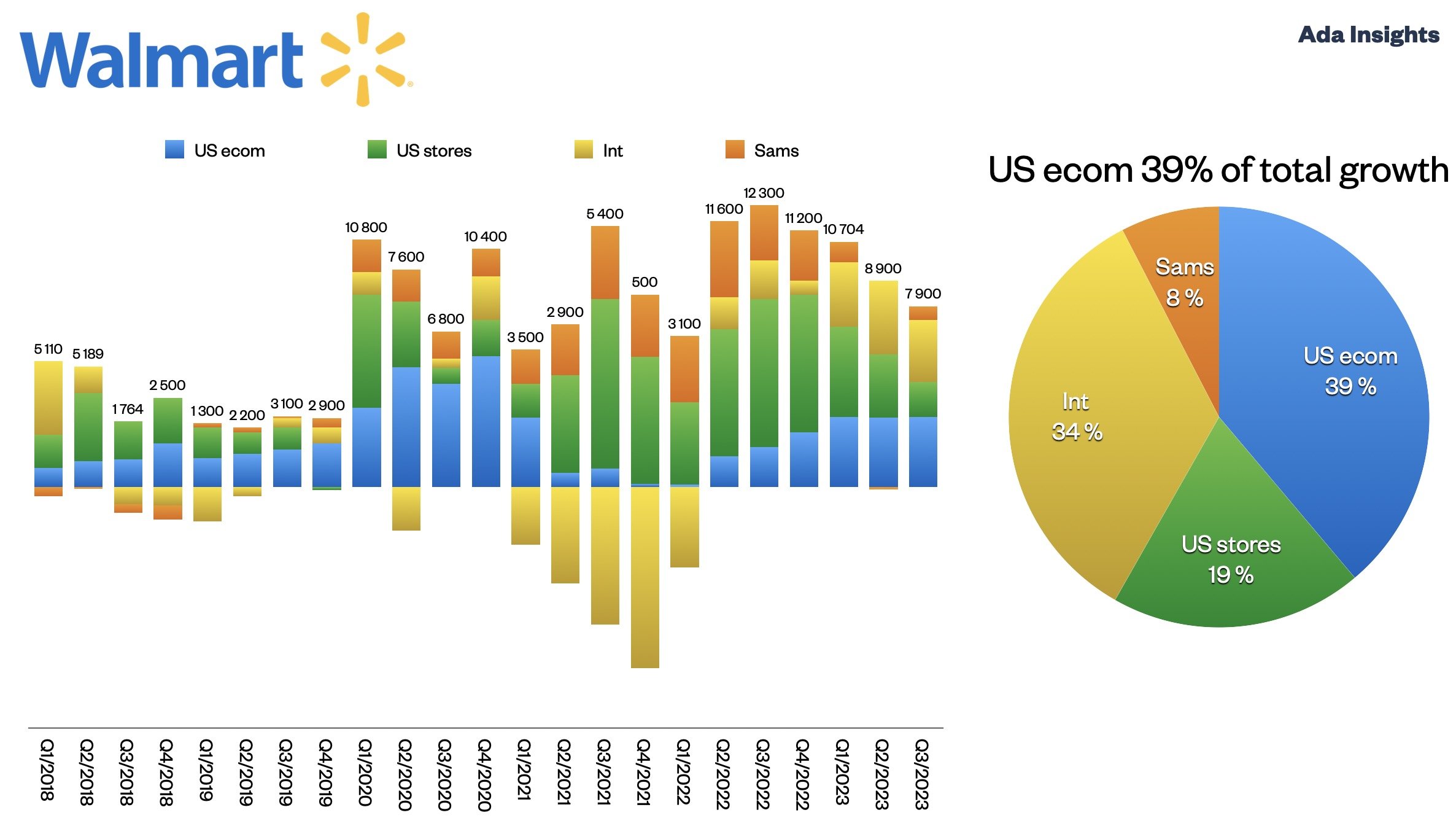

Of the business segments, the growth was driven by US ecommerce, which continued to grow by +24%. This growth equals a total of $3 billion growth, almost precisely double the absolute growth that was reported by the US store business.

The last time ecommerce reported double the absolute growth compared to stores was during the pandemic.

US ecommerce was the company's biggest growth driver, even more than the International segment. This growth puts ecommerce at 14,5% of all US revenues ($60+billion).

With the increasing revenue share going online, Walmart is investing in improving the channel's profitability. One such measure is to strengthen fulfillment efficiency with next-generation ecommerce fulfillment centers and Micro-Fulfilment Centers (MFC). The company reported opening three next-generation fulfillment centers and is on track to open its seventh MFC by the end of this month.

“The profit and loss statement of the digital business ”flows from 1st and third-party e-commerce, pickup and delivery to businesses like membership, advertising, and fulfillment as a service. It includes some faster-growing, higher-margin components that, combined with the more traditional P&L, gives us a more profitable model in percentage terms as it grows. … And when you put it together with the supply chain automation work we’re doing, you get a more sustainable business that can grow more effectively over time and create a better mix along the way.”

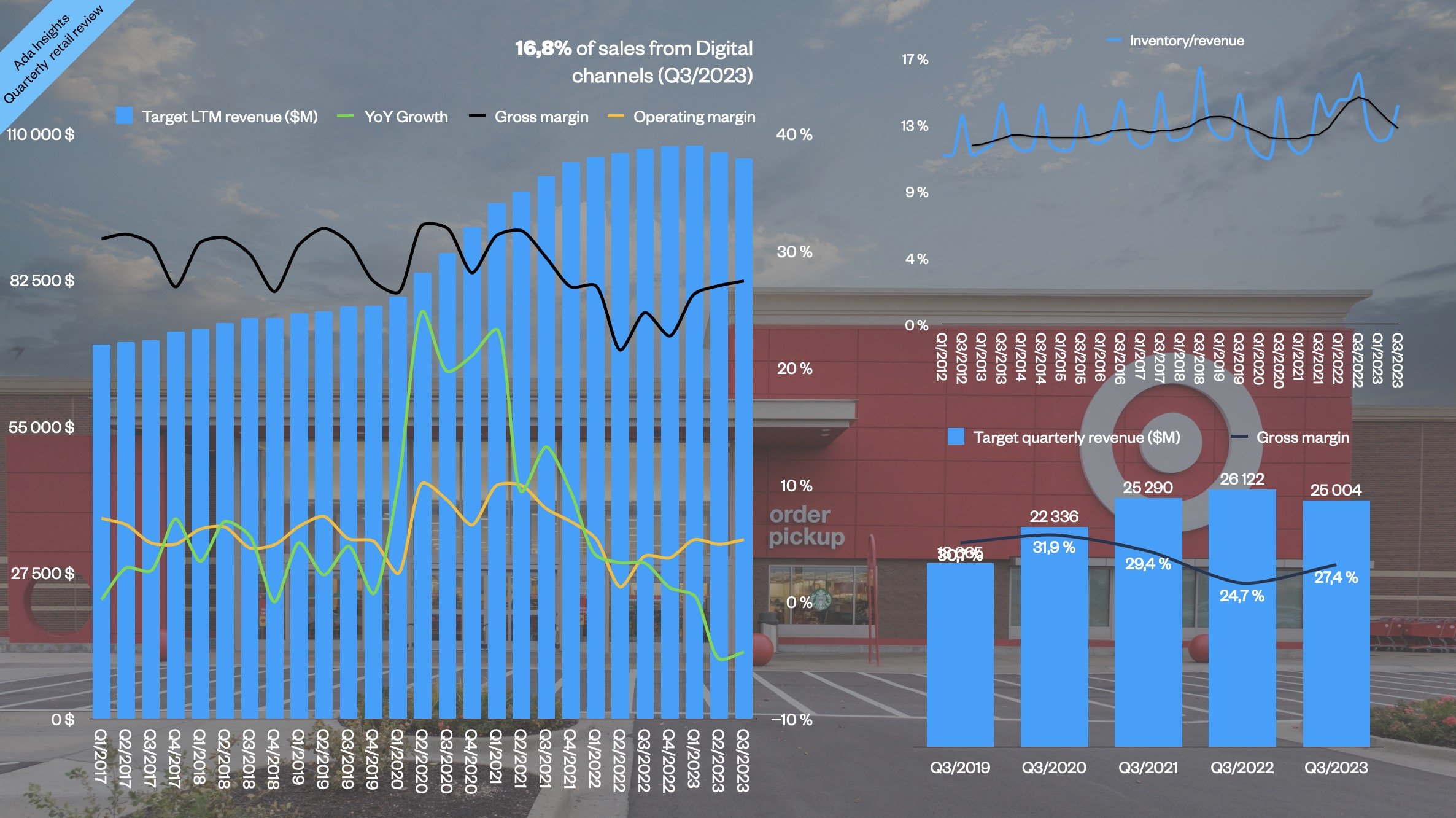

Target and Home Depot are struggling to grow with a non-food focus

While Walmart continues to grow with the low price image and big share of groceries, non-food giants Target and Home Depot continue to see their revenues decline. With -4,3% revenue drop, Target tried to spin the quarter as positive because the margins and profitability did improve. Gross margins jumped from 24,7% to 27,4%. This helped the company to increase Operating income by almost 30%. The Operating margin improved from 3,9% to 5,3%.

On the other hand, it is good to remember that Target was struggling mightily with bloated inventories a year ago. The company started to cut down on inventory levels with deep discounts in Q2/2022 and continued to the next quarter. Thus, the comparative profitability numbers for this quarter are relatively low. Now, the company has pushed the inventory levels to historically normal levels. Maybe this helps Target to push for a more financially sustainable last quarter this year.

“One of our top priorities this year was to rebuild our profitability following the unique challenges we faced in 2022. And while there’s lots more work ahead of us, I’m really pleased with the progress the team has delivered so far this year.”

Home Depot has seen revenues decline one quarter longer but with slightly smaller percentages. Contrary to Target, Home Depot has seen the Gross and Operating margins decline somewhat as the market has cooled down.