Is Boozt becoming a modern department store?

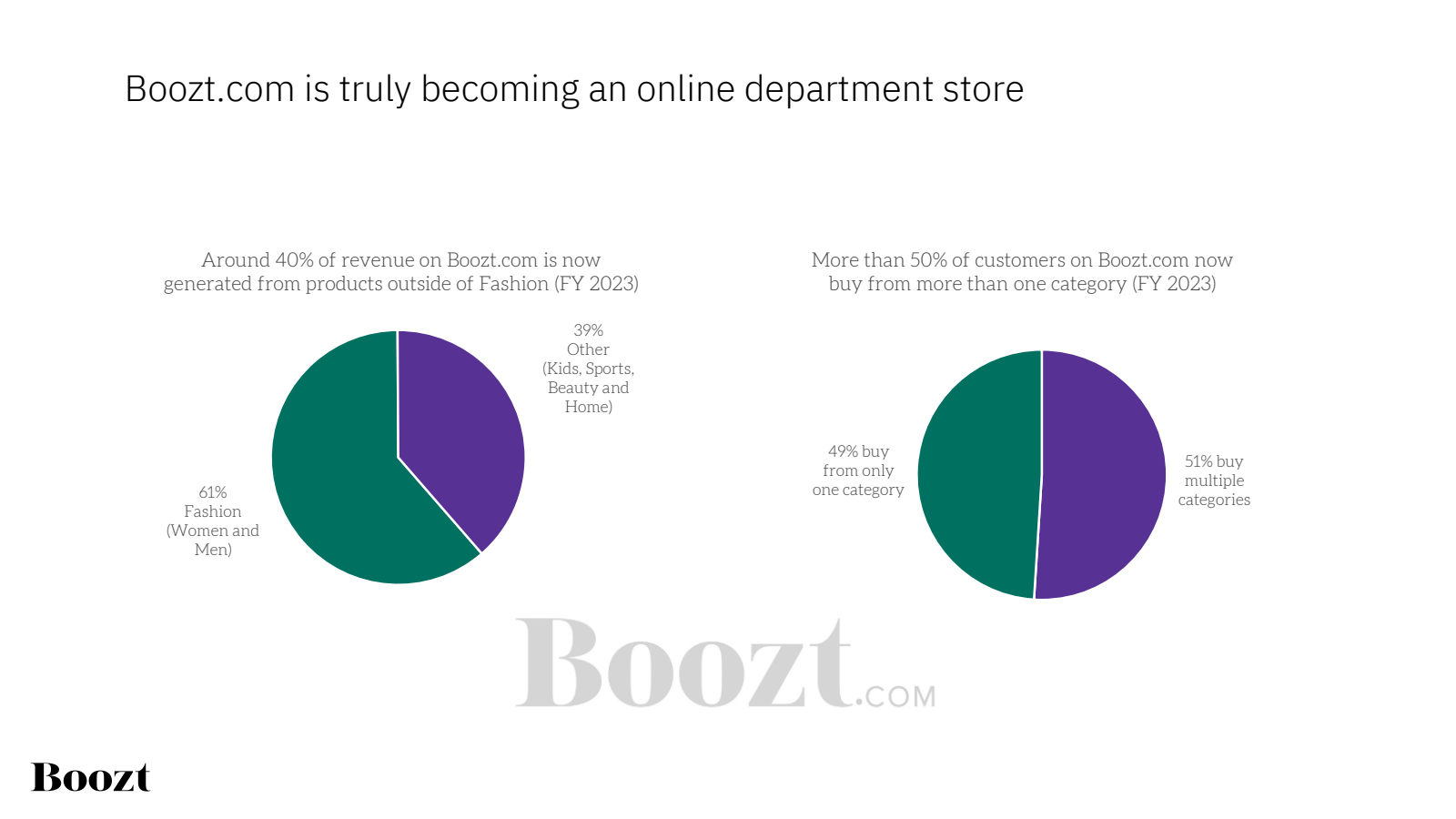

The biggest pure-play online retailer in Sweden, Boozt, claims to be a Nordic department store. The fashion image is strong with the company, but they have broadened the assortment from a more fashion-focused to cater to home and cosmetics.

These are the traditional categories that the department stores carry most often.

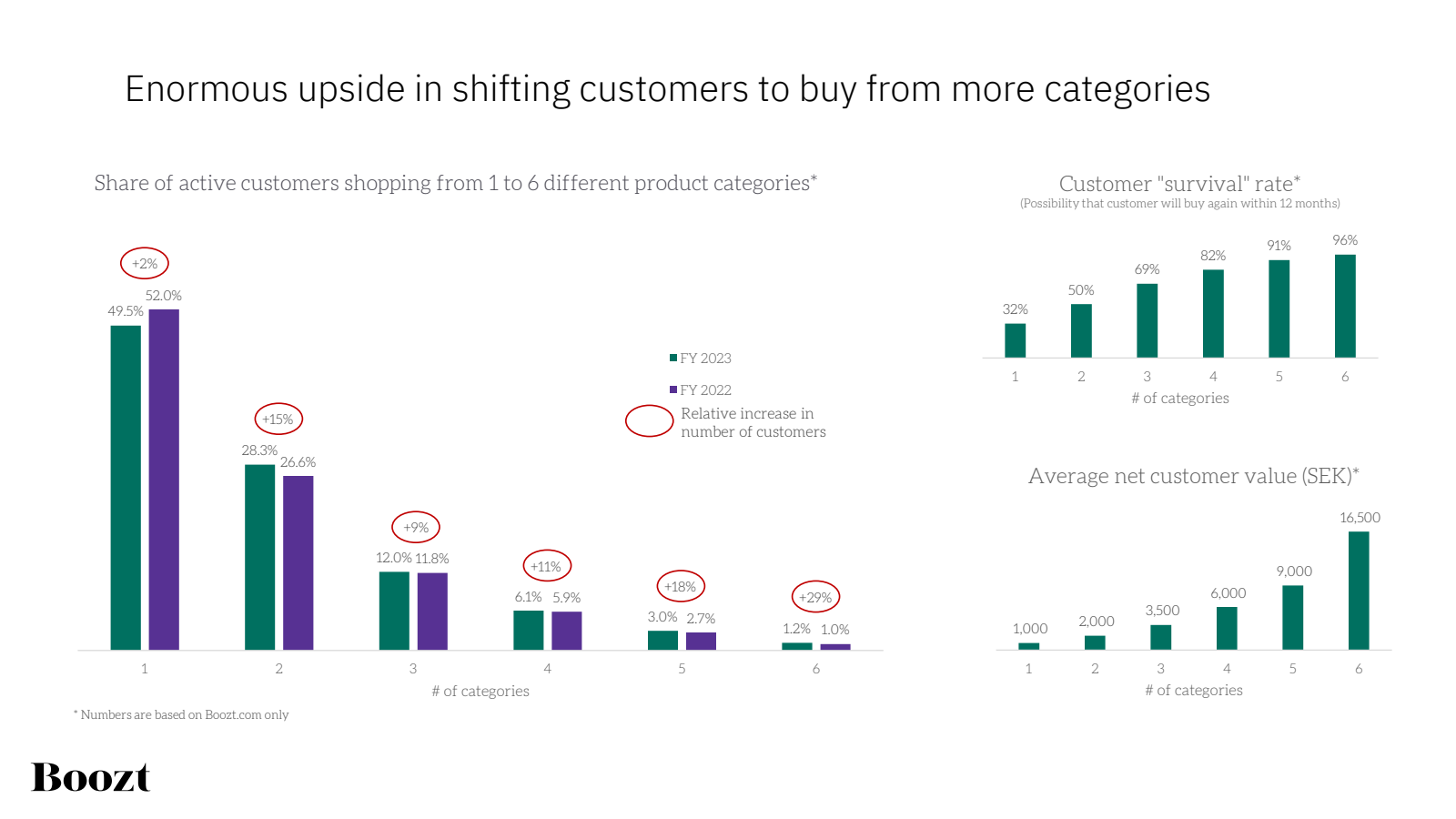

Boozt seems to be becoming a genuinely modern department store as the company is growing very strongly with their pure online model. The department store aspect is emphasised as Boozt has been able to broaden the products customers buy from them.

The improvements were supported by an increase in customers putting more than one category in the basket, further validating Boozt’s Nordic Department Store strategy and currency. In Q4 2023, 51% of customers bought from more than one category, compared with 48% in Q4 2022. Finally, there was a tangible reduction in return rates compared with last year, mainly due to increased sales of categories outside of fashion, which, on average, have lower return rates.

“The improvements were supported by an increase in customers putting more than one category in the basket further validating Boozt’s Nordic Department Store strategy, as well as currency. In Q4 2023, 51% of customers bought from more than one category compared with 48% in Q4 2022. Finally, there was a tangible reduction in return rates compared with last year, mainly due to an increase in sales of categories outside of fashion, which on average have lower return rates.”

The most impressive part of the Boozt business is the ability to grow rapidly but, at the same time, be profitable. As the growth of many online fashion retailers has plateaued, Boozt has grown throughout the pandemic and high inflation eras.

The Boozt growth model's strength lies in the breadth of the categories offered and the geographical expansion. The company has been able to grow its revenues outside Nordic countries. The ”Rest of Europe” segment has grown from 73 million SEK in Q4/2019 to 301 million SEK last quarter.

Another vital aspect is the growth of the discount segment of the business, Booztlet. It has capitalised on the price-sensitive nature of the last two years. The segment has reported impressive growth from Q4/2019: 75 million SEK to 475 million SEK. This growth has doubled the share of business coming from the discount segment to 16%.

Regarding the overall profitability of the Boozt business, the gross margins declined slightly (heavy promotions drive some of the growth, especially for Booztlet). This was offset partly by the decreased cost burden of fulfilment, and marketing declined somewhat.

The broadening of the assortment from fashion is good for the company's profitability as the return rates for cosmetics are lower than for fashion.

Also, the inventory levels were managed conservatively. The slimming of inventory also helped to boost profitability slightly. However, administrative costs took a more significant share of revenue (i.e., grew faster than the revenue), and thus, the margin drop also slightly influenced the EBIT margins.

One must remember that online fashion is not famous for high profits, and Boozt has been operating a higher profitability business than its peers, such as Zalando, ASOS, Boohoo or About You. At the same time, Boozt has continued its rapid growth contrary to its peers.

“For the full year 2023, net revenue increased 15% (or 11% in local currency) to SEK 7,755 million (6,743). The increase was driven by all product categories, however, the categories outside of fashion (Kids, Sports, Home and Beauty) increased the most, again highlighting that customers continue to embrace the Nordic department store offering”