Ocado, Instacart and others driving online grocery growth

Online grocery markets have seen challenging years after the pandemic growth leaps. Some companies saw deep revenue declines, whereas others saw merely a slowdown in growth. The latter part of 2023 has been a turning point for the online grocery markets worldwide.

Online grocery in the UK is growing again

Ocado reported a +7% growth and a return to profitability. This was driven by growth in all meaningful metrics. Number of active customers grew most rapidly by +5,9%. However, the overall increase was driven by the rising prices as inflation in the grocery market in the UK was 7,9%.

Part of the growth was likely due to the price promise given by Ocado. The company has pledged to match the prices of more than 10 000 products to the prices of the market leader Tesco.

The profitability improvement was driven by higher Gross margins (+7,7%) and improved efficiency. The latter was influenced by the ”improved range and stock management, reduced wastage, and increased delivery income”. Also, cost control and productivity improvement in the fulfilment centres helped the company drive profitability.

Ocado revenues have grown steadily since the first half of 2022. After four consecutive quarters of declining revenues, Ocado has now been able to grow revenues for six consecutive quarters.

Alongside the strong growth of Ocado in the UK, the market leader Tesco reported even better growth. Tesco saw online revenues grow by +12%.

The market for online grocery in the UK is on the growth track again. According to the Office for National Statistics (ONS), the share of groceries going through online has increased for six consecutive months.

Ahold is seeing diverging success with online

Another significant international brick-and-mortar grocer, Royal Ahold, also reported strong growth for the online channel. However, for Ahold, the growth was more divided. The European online grocery business saw revenues increase by +7% last year. This was driven primarily by the development of Albert Heijn’s online business in the Netherlands.

On the other hand, the US online grocery revenues have decreased for two consecutive quarters. This led the 2023 total growth to slow down to 2%.

The online channel is significantly more mature for Ahold in Europe than in the US. In the US, the online share of the total business is 7,8%, whereas in Europe, online represents 15,3% of revenues. The European online business for Ahold is already a 7,6 billion € business.

The market for online grocery in the US does not seem as negative as the figures from Ahold might suggest. According to the Census Bureau, it has continued to grow throughout the pandemic and inflationary times. In 2023, the online channel grew by 6,3%.

Instacart driving growth in the US

The biggest pure-play online grocery platform in the US, Instacart, also reported more encouraging numbers. The Gross Transactional Value (GTV) of the trade on the company’s platform has grown steadily after the pandemic. Last year, the GTV grew by 5,2%.

The revenue growth of Instacart is slowing down, albeit faster than the growth of GTV. The revenue growth dropped to single digits: +6,1%. It was driven by the slower growth of the transaction revenues (5,7%). The Ads business grew slightly faster, with a 7% growth. The Ads represent 30% of Instacart revenues and are a far bigger income generator than what Instacart is spending on marketing.

For Instacart, Ads are a 26% bigger revenue generator than marketing is an investment. This significantly contrasts with Amazon, which has generated more revenue from Ads than it spent on marketing during the last two quarters. Currently, Ads generate 12% more money than is spent on marketing.

Also, Walmart reported strong growth in its online business. During last year, Walmart’s e-commerce business grew by a robust 22,5%. However, one has to remember that a significant share of Walmart’s business (primarily online) comes from non-food categories. Non-food categories have tended to grow faster online than grocery products.

Online grocery back on the growth track

From the Nordic perspective, these results from the big European and American grocers are reinforced by the Nordic grocers. The big grocers (ICA, Axfood, Kesko and S-Group) reported growth in their online businesses. ICA and Kesko reported slightly smaller growth figures. ICA reached growth with the online channel only in Q4/2023.

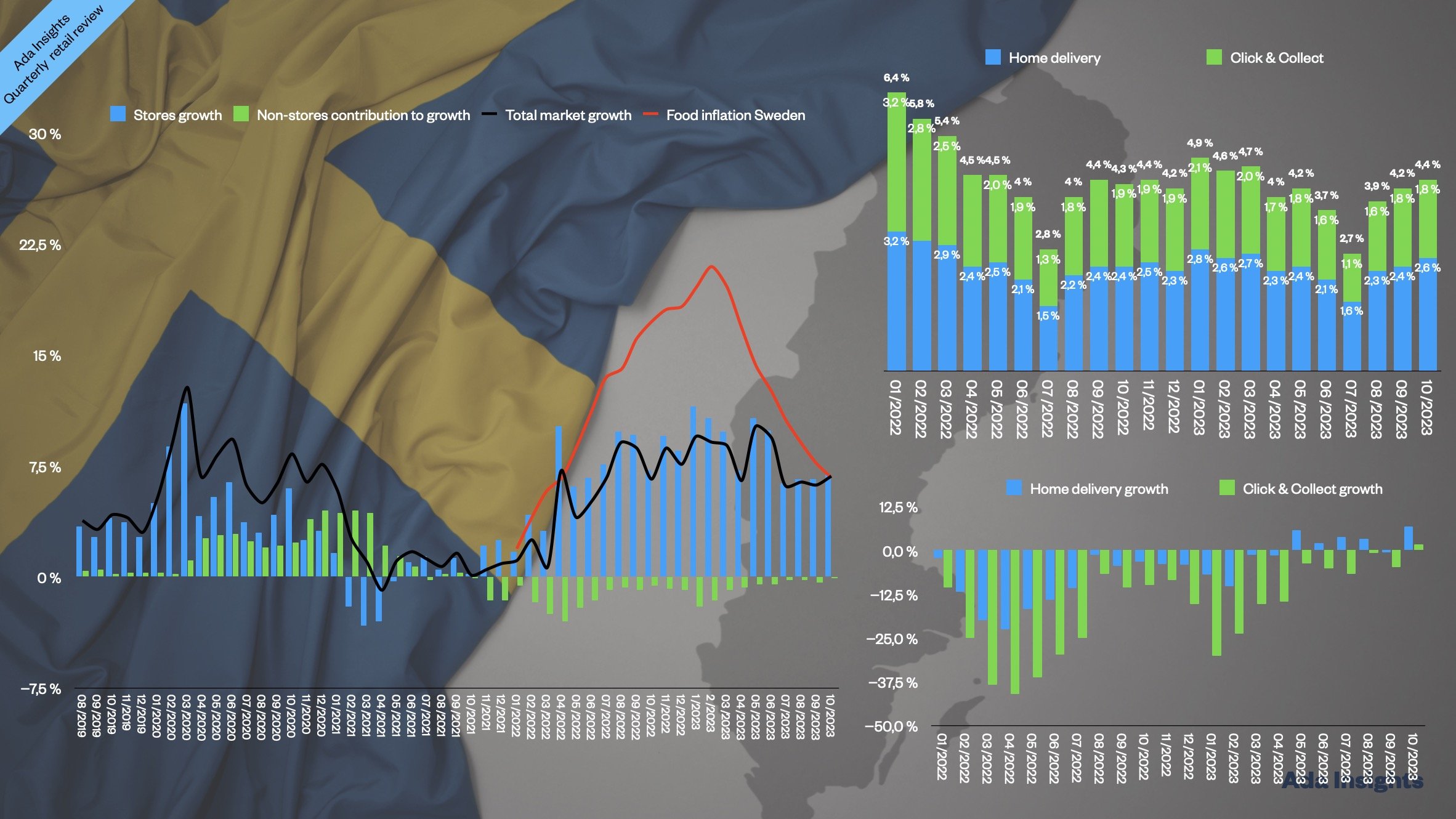

Of the pure-play online grocers, Oda has continued its robust growth trajectory. The other Nordic online grocers, Mathem and Nemlig, are still suffering from declining sales. The grocery market in Sweden has also seen a robust return to growth, especially with home delivery.

However, with the online grocery data, one can conclude that 2023 has been a year of bouncing back for online grocery businesses. Almost all of the leading players have returned to growth. This indicates that 2024 could be a more robust growth year. Online grocery could return to its long-term growth trajectory and continue to grab market share from the physical formats.