Q3/2023 reiterates the strength of the Costco model

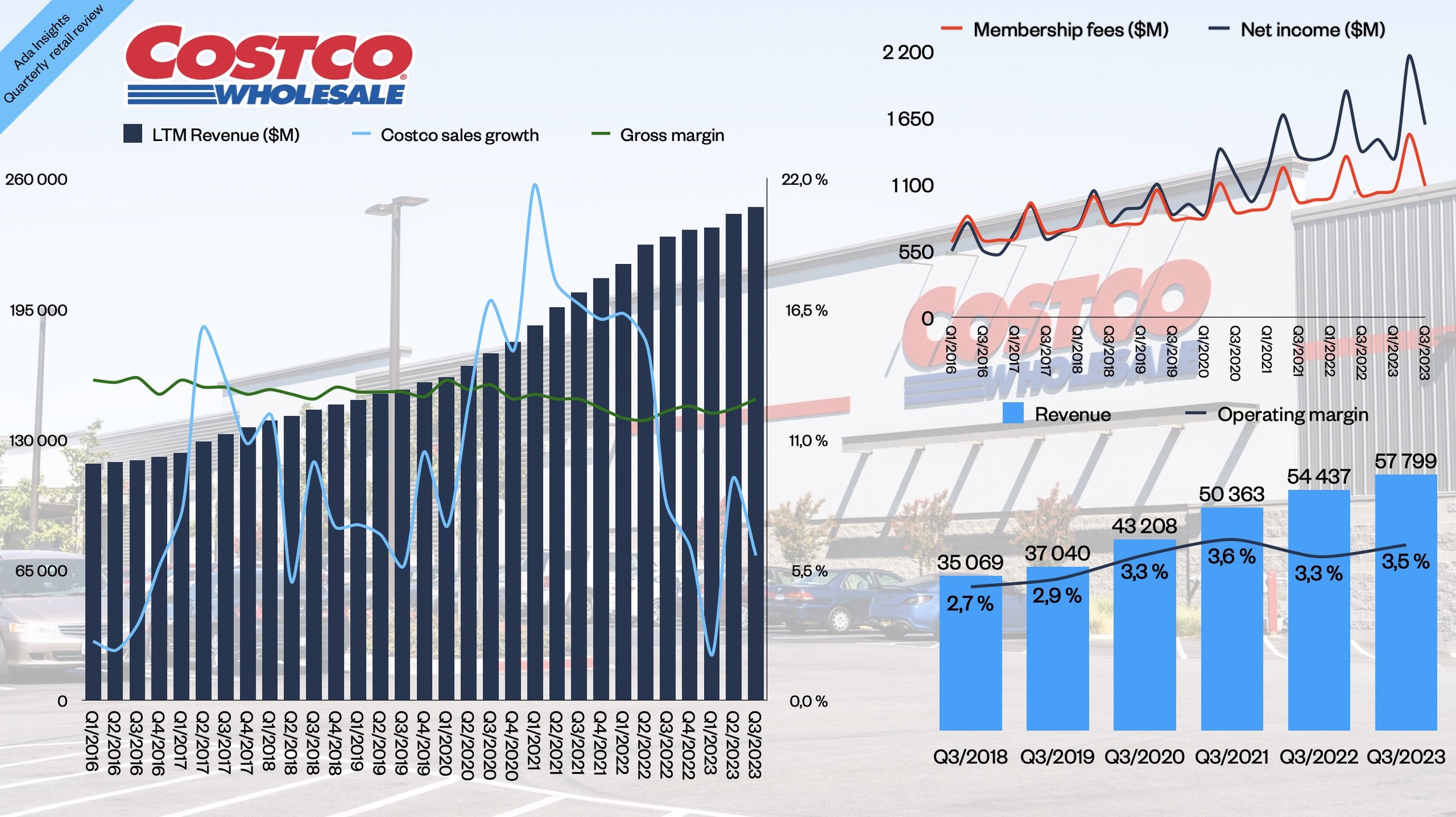

Costco reported another strong quarter during challenging times for brick-and-mortar retailers. The company saw revenues increase by 6,1%. In comparison, Walmart’s US business reported 4,4% growth. Costco’s direct competitor in the Walmart ecosystem is Sam’s Club, which reported only 2,8% growth.

The growth was driven by increased customer traffic even though the average basket was down slightly. Of the different categories, Costco relied heavily on groceries as customers gravitated towards essential products. As Costco CFO Richard Galanti said: ”Overall, for the first fiscal quarter, fresh foods were relatively strong once again, with food and sundries right behind.”

Costco outpacing rivals with value

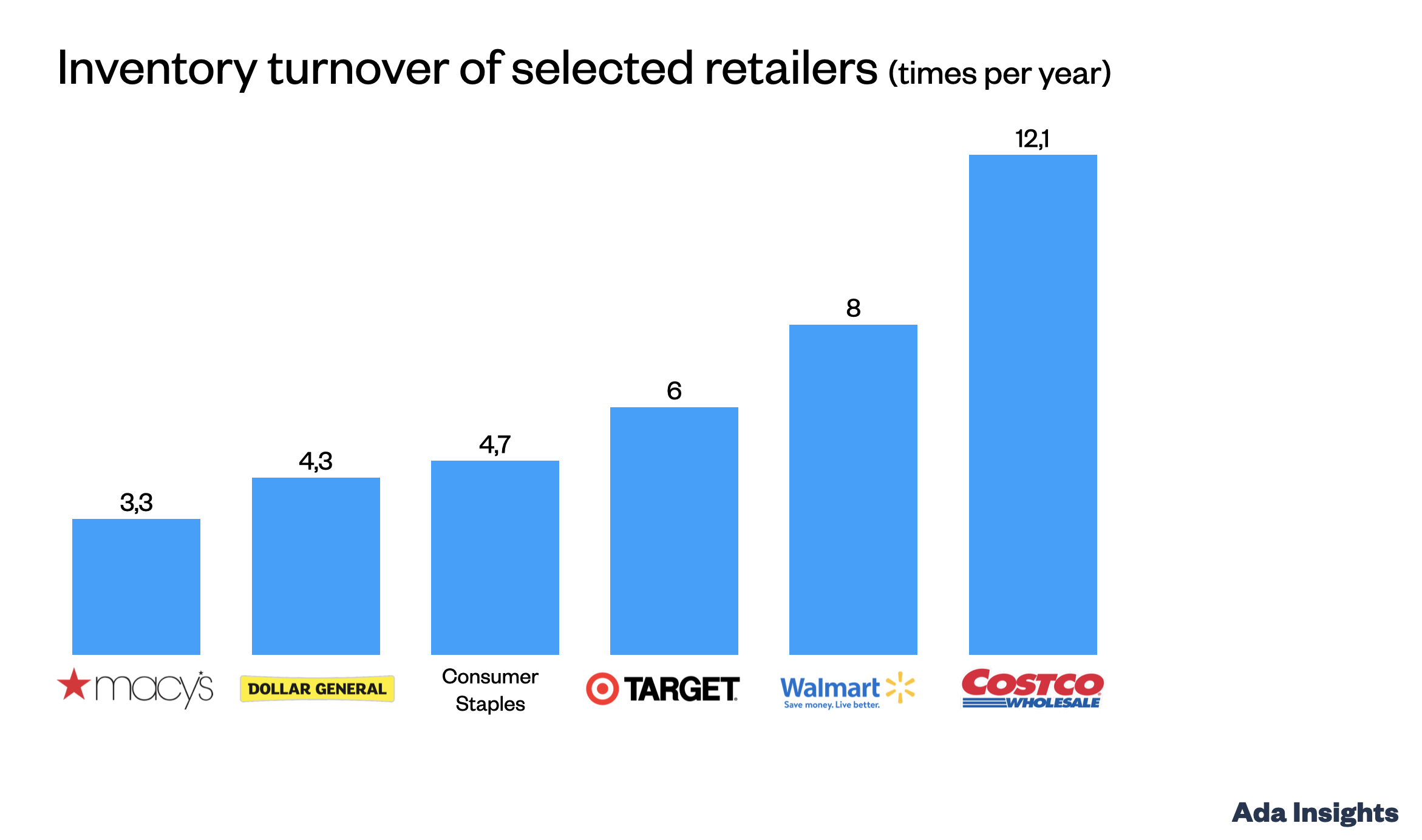

Walmart had been, so far, the most resilient among the big US retailers. Costco’s performance shows the strength of its business model. Similar to IKEA, the Costco model is robust during difficult economic times when customers gravitate towards value. The model also works during better economic times.

However, despite the Costco model being perceived as low-price, customers did splurge at Costco. Richard Galanti shared an interesting detail.

“You’ve probably read about the fact that we’re selling 1-ounce gold bars. We sold over $100 million of gold during the quarter. We sold a Babe Ruth autographed index card for $20,000.”

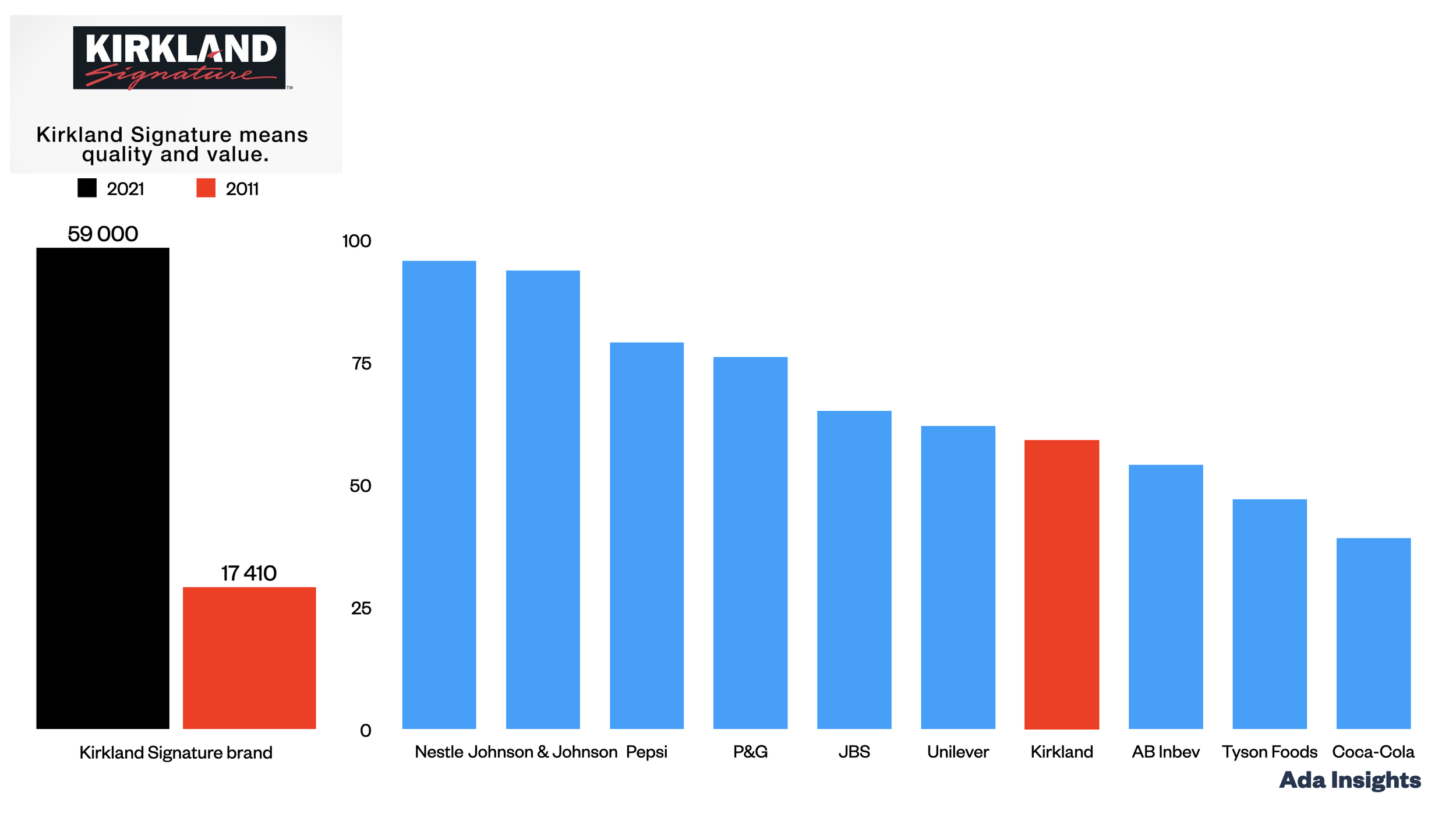

The most astonishing fact about Costco remains the loyalty of their customers. Membership fees outgrew the revenue growth (6,1% vs 8,2%).

The loyalty is emphasised by the renewal rates. In US & Canada 92,8% of customers renewed their memberships. Internationally the figure was 90,5%.

Costco continues its robust growth as it plans to open 31 new warehouses. The figure is up from 23 new warehouses during the previous fiscal year. Regarding Like-for-Like growth, International is driving growth growth (ex currency changes) 11,2% vs 2% in the US.

Value speaks to all generations

One common theme about Costco is the fear that the company would not attract younger customers. This fear seems to be unwarranted, as Costco can attract younger customers. First, they spend less (as younger customers tend to do), and they start spending more as they mature.

“I remember 10-plus years ago, people would ask you, how are you going after millennials? And then it’s how you go after the Gen Zs? At the end of the day, when we look at the different cohorts, if you just change the names, the curve seems to be about the same in terms of getting new younger members. They buy less at first. They buy more as they get older into that 40- to 55-year-old sweet spot.”