Costco and Walmart growing as other retail giants stumble

The big American retail giants are an excellent bellwether for the health of the American retail sector. They also indicate what kinds of retailers and concepts are growing at the moment. When comparing Costco, Walmart, Target, Home Depot, and Lowe’s, one can easily conclude that online and groceries are driving growth at the moment.

The five giants also illustrate the difficulties associated with non-food retailing in general. Especially the DIY giants, Home Depot and Lowe’s, have struggled lately.

Home Depot and Lowes struggling

Both have seen growth ground to a halt since the start of 2023. At the same time, the overall US DIY retail market has declined. However, the two retailers have fared somewhat differently during this downturn.

Lowe’s has gone much deeper into a sales decline. The company has seen sales drop by more than 10% during the last two quarters, and the decline has accelerated for four quarters.

On the other hand, Home Depot has seen relatively stable low single-digit declines.

Target rebounding after a challenging year

The non-food discount department store chain Target faced difficult times during early and mid-2023. The company is rebounding from a difficult period of two to three quarters. The sales decline has turned to slow growth during the last quarter.

However, comparable growth was still slightly negative in Q4 and for the full year's sales. The company also expects early 2024 to have negative comparable sales.

The bigger story in the Q4/2023 of Target was the improved profitability. The company increased all margins (gross, operating and net). They all have grown steadily since the low point in Q2/2022. This was when Target started aggressively cleaning out its excess inventory gathered during the pandemic. The inventory levels have declined for the last five quarters, taking the inventory levels from the highs of 16% (Q3/2022) to 11,2% of revenue in the previous quarter. The value of Target’s inventories has gone down by six billion dollars.

The biggest growth driver for Target was digital. Digital sales grew by +4%, against 1,6% for total revenue. Within online, the growth was robust in Same-day services, which grew by +13%.

Same-day services represent more than 10% of total Target revenues. Total online sales represented 21,3% of sales in Q4. This level is closing on the pandemic era highs (peak 22,1% in Q4 2020). In absolute revenue numbers, online is already bigger than during the pandemic era. Target’s online operations reached a record revenue of $6,7 billion.

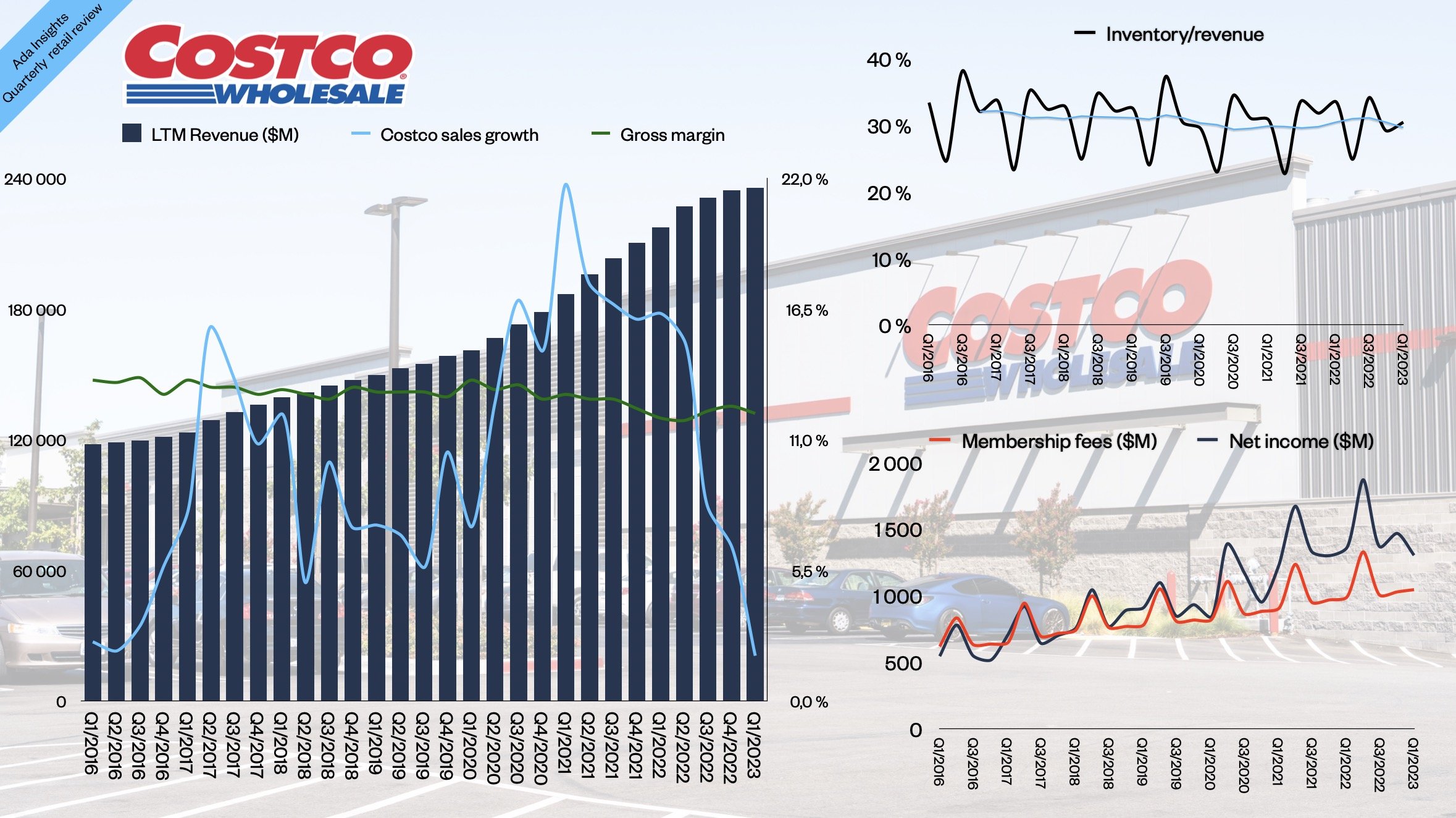

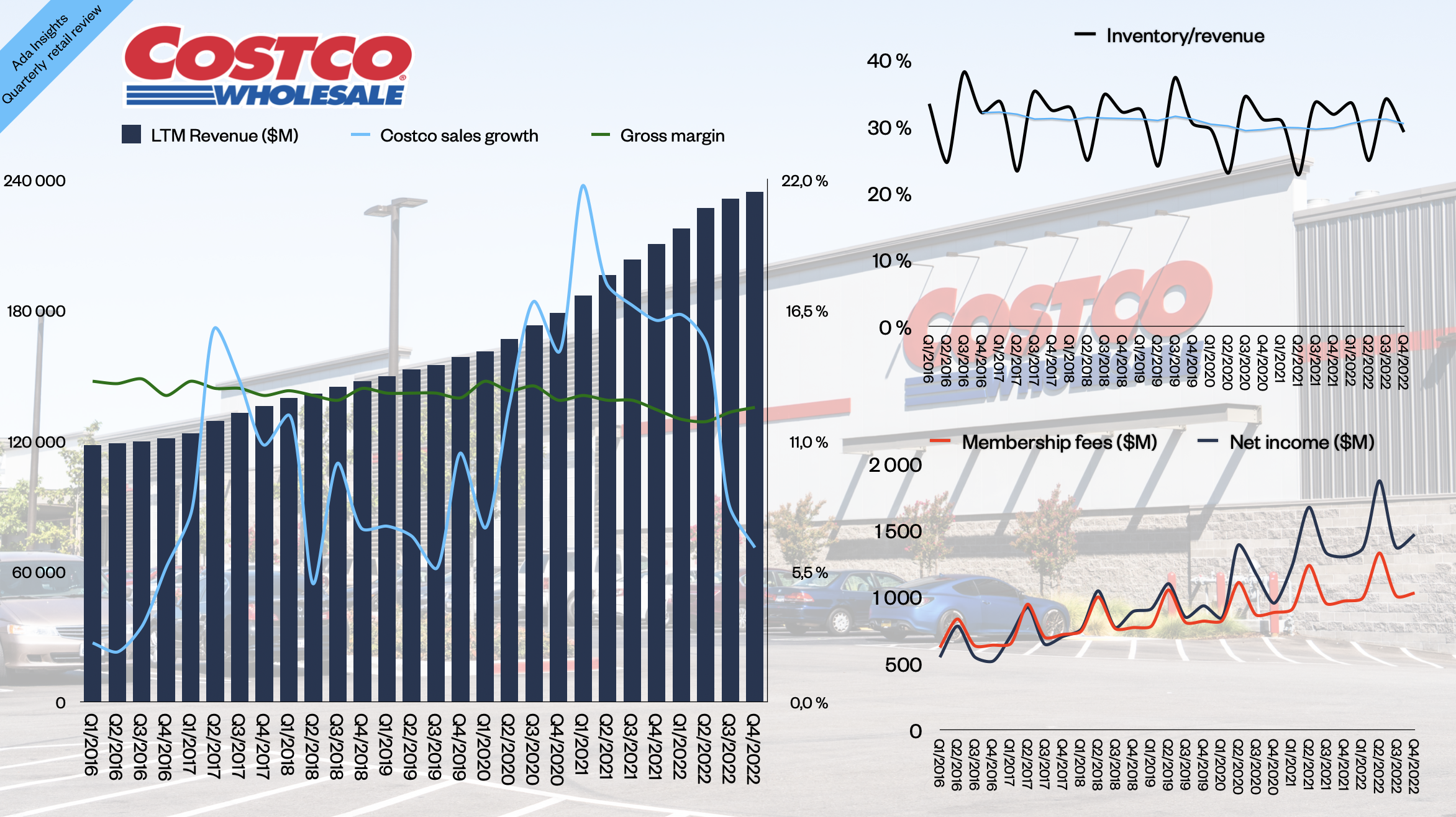

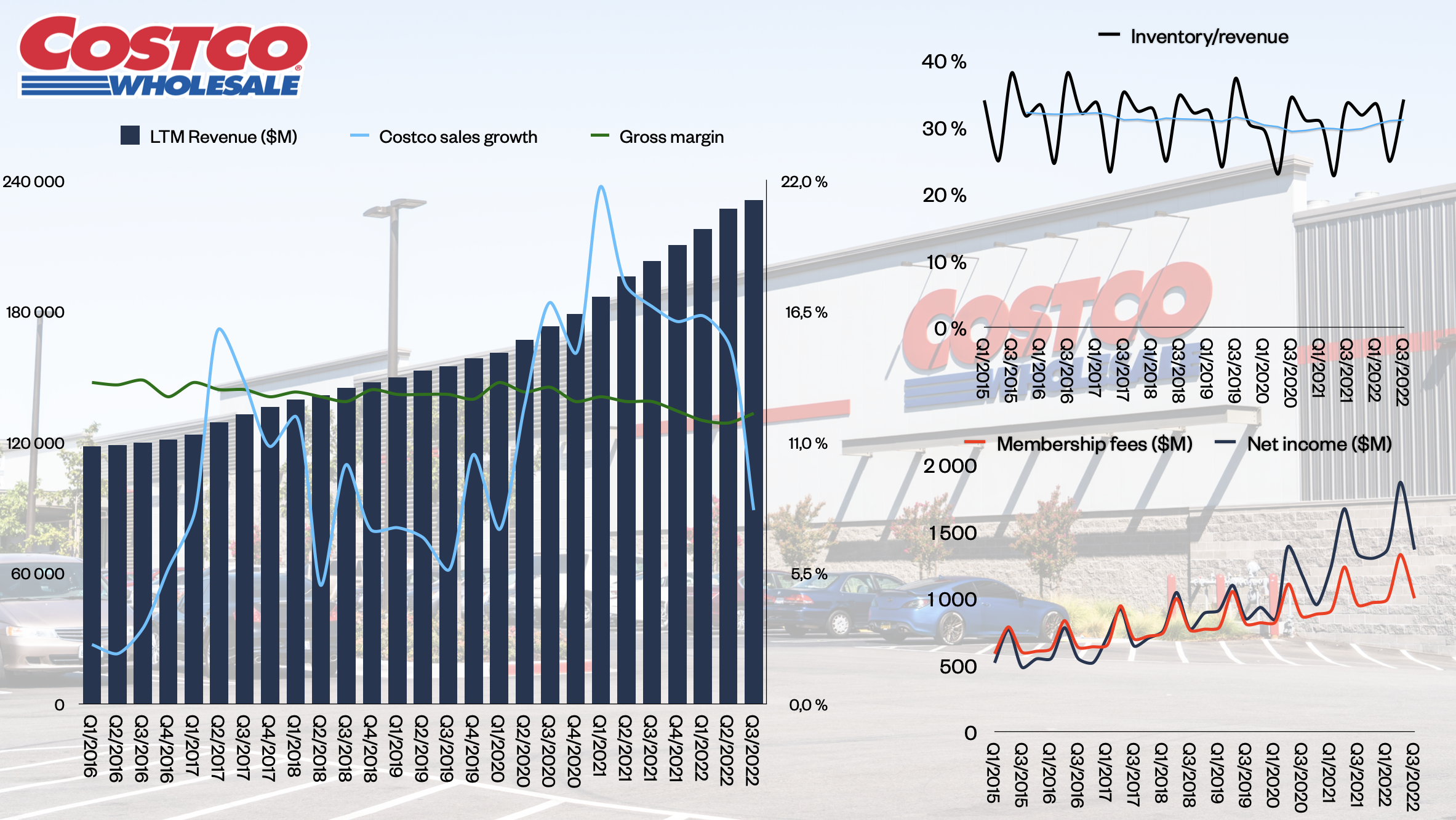

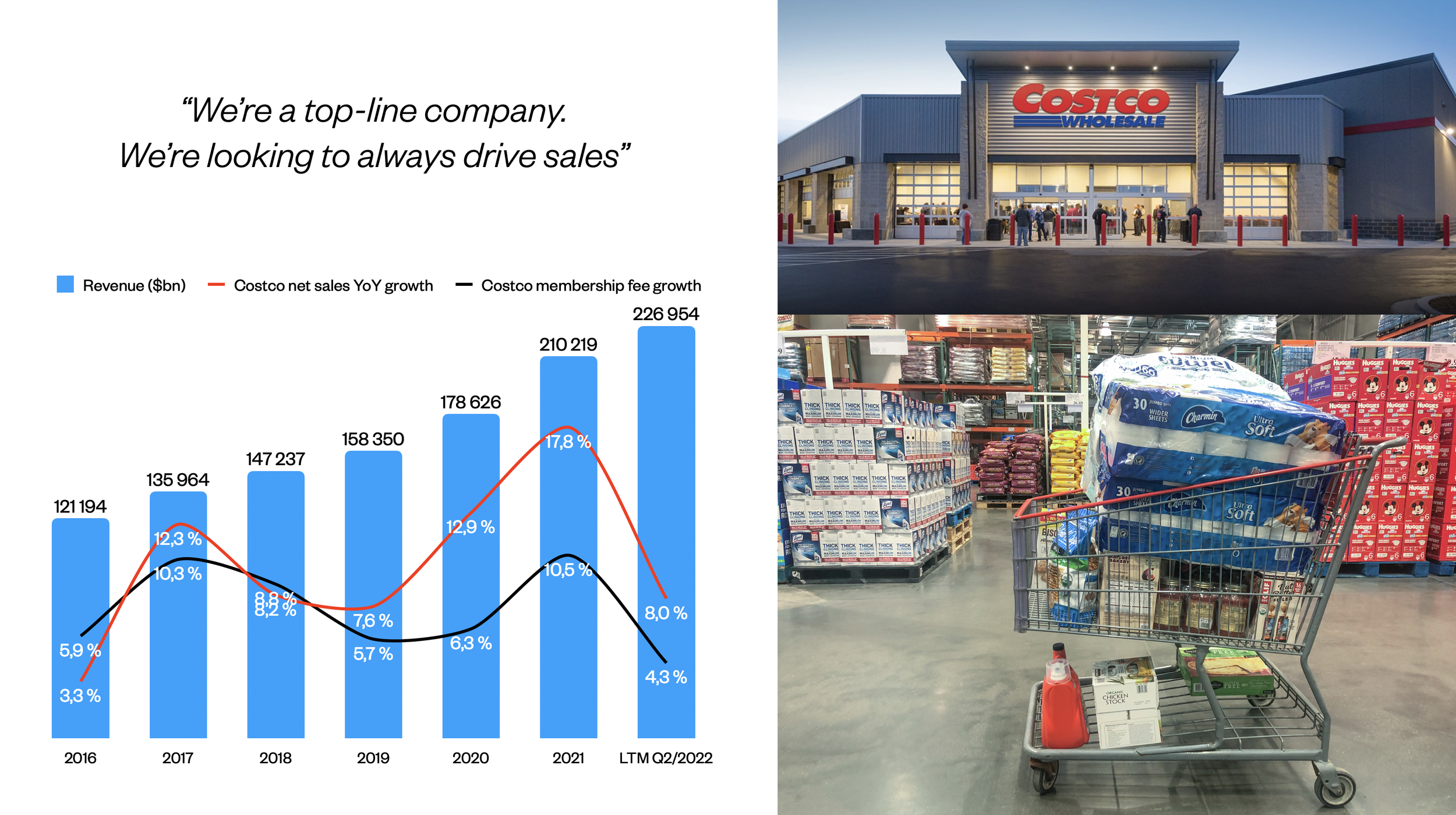

Costco, with robust results driven by food

The warehouse club behemoth Costco reported robust +5,7% growth for Q4/2023. This is slightly less than the long-term average of Costco’s growth. The growth was driven by food products. According to Costco CFO Richard Galanti, the Food and sundries category grew by double digits, whereas fresh foods grew by high single digits.

Despite growth being on the lower side of the company's historical average, Costco grew much faster than its main rival, Sam’s Club, which grew at 2,3%. Another significant growth driver for Costco was the Canadian and International businesses. They grew between 8% and 9%, almost double the speed of the growth in the US business.

The fastest-growing part of the business was e-commerce, which grew by 18+%. However, e-commerce is probably a tiny percentage of the total Costco business.

One exciting caveat was uncovered in the earnings call. Instacart orders represent ”something below 2% but more than 1,5%” US revenue. According to CFO Galanti, this would be a $200 million business.

Costco does not include this revenue in the company’s e-commerce figures as it is done by a third-party shopper who goes through the store like an ordinary shopper.

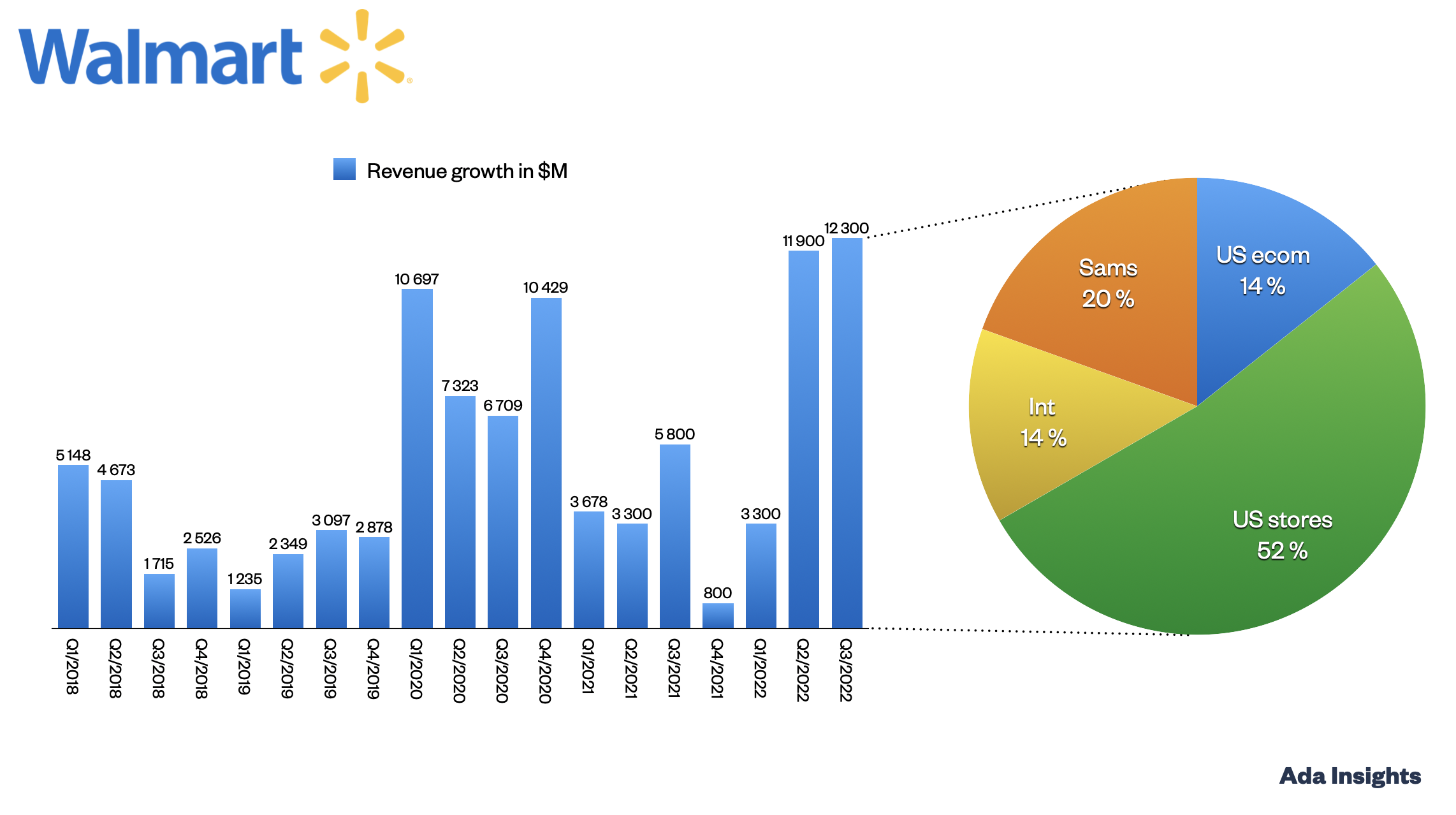

Online and international driving growth for Walmart also

Walmart is the last and biggest of the US retail giants. The company's growth was similar to that of Costco, +5,7%. Like Costco, Walmart’s growth was driven by the international segment, which grew by +17,4%.

The International segment has grown rapidly in 2023, with growth above 10% during all four quarters of the year. On the other hand, Sam’s Club has been lagging, with its fourth consecutive single-digit growth quarter (Q2 saw a slight decline).

The growth in the biggest segment, the US, has gradually declined. In Q4/2023, it was at 3,4%. This was Walmart's fifth consecutive quarter of declining growth. The US growth was driven primarily by e-commerce, representing 72% of all US growth.

For 2023, e-commerce represented 14,9% of all US revenues. Walmart's US e-commerce business is a $65+ billion business. As a standalone business, it would be a top 20 retailer worldwide.

With a robust online business, Walmart is the only serious US-based competitor to Amazon, as noted by the Marketplace Pulse. Amazon has returned to double-digit growth in total revenues and high single-digit growth in product sales.

However, Walmart’s US e-commerce is growing double the speed of Amazon’s global product sales. Walmart's total e-commerce revenues (including International e-commerce) grew even faster, +23%, more than four times the speed of Amazon’s product sales growth.

To compare the two e-commerce companies, Walmart said its annual global e-commerce revenues surpassed $100 billion, while Amazon’s global annual product sales exceeded last year's $250 billion.

Online is becoming a growth driver for big business, again

After the pandemic, the discussion around online retailing started to turn from nearly hyped during the pandemic to gloomy in late 2021 and early 2022. Walmart's US business is a showcase for this. Before the pandemic in 2019, online (e-commerce in Walmart language) became an important growth driver for the company, representing more than 50% of growth for the US business.

During the pandemic, online was naturally very important for growth. After the pandemic, online was barely growing between 2021 and 2022. Since early 2022, online has rapidly increased its share of growth.

Besides Walmart, online was the only part growing for Target. Also, Costco saw the fastest growth in the online channel. Also, the overall online retail market is growing faster than the overall retail market. According to Census Bureau, in Q4/2023, online grew by 7,2%, whereas the stores grew by 1,5%. Online represented 17% of all US retail sales in the last quarter of 2023.

The tide of online retailing is changing back to growth, as even the biggest of the big are turning to online to increase their growth rate. This will be an important example for the smaller multichannel retailers and naturally contribute to the growth of the overall transition to online retailing.